James Whelan

- Apr 29, 2024

- 5 min read

Big end and small end corporate action, copper, China, Japan, fine wines - Market Map with James Whelan

New job, new firm but the same Free Whelan. Thank you for your continued support and keep unlocking valuable insights into the global market every week with me!

A brilliant podcast was recorded last week with substantial relevance. Heath and I talk to Dave Allen of Plato’s Long Short Alpha Fund. He’s an absolute genius and tells a good market tale too.

Good ol’ days

I was recalling to some colleagues a time long ago one of my first broking jobs as an operator/lackey for a hedge fund sales team. One of my jobs of the day was to collate all the new merger and acquisition activity, calculate any arbitrage, and update files on counter offers or increased bids. Just basically track the M&A market.

I was never short of work.

That 2005-2007 period and post the GFC was a wonderland of small and mega deals. I remember it was an absolute banger of a deal in which one energy company made a counter-takeover of another energy company that had made a takeover for them and Mac Bank had to ask ASIC if it was ok for them to have a separate Mac Bank deal teams on either side of the transaction. Just wild days.

Then it all dried up and it was only once in a while that something would come up.

Then, BHP comes out with a monstrous, and quite complex, $60b takeover of Anglo American.

You don’t need to be a market insider to know the motivations because the BHP CEO mentions it about 40 times in any interview he’s given over the last few days.

Copper.

Do you really want me to go over it again?

It went through a new 2-year high of USD10000/tonne into the weekend just gone and I’m still a buyer of dips.

Not only is the recent rally all, or mostly, about China, which accounts for 50% of global use. But the focus on the underlying reasons is the rise of EV cars in that country coinciding with the turnaround in China itself.

Then to have the head of the largest diversified miner in the world broadly announce that the reasons they want to become the biggest copper miner in the world is purely because there’s an inevitable shortage of the stuff and you get as clear a picture on the future as you need.

I thought I’d post a monthly copper futures chart (in pounds) dated back to when I started in broking.

Source: TradingView

The monthly candle for April is about as good as any on this chart. Just staggering.

As much as I hate to be “that guy” you’d have to think that long term this potentially bangs its head on the ceiling before the next most probable thing happens to the upside.

Be sensible.

Japan wow

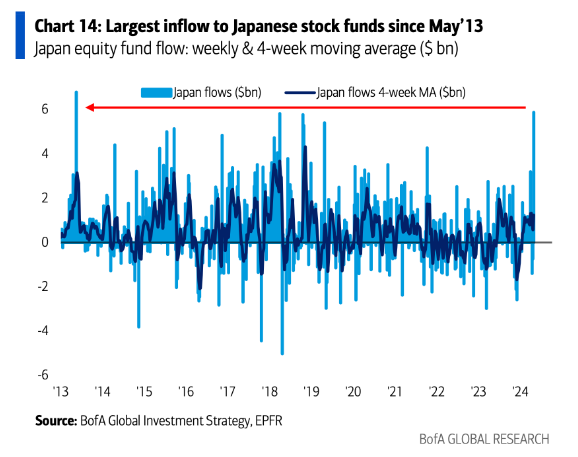

Meanwhile one of the big calls made towards the end of last year was to go long Japan on the unwinding of the negative rate position and yield curve control. There was a lot of money on the sidelines just waiting for inflationary urges to force their hand on investing. Oh, my hasn’t this been something?

Source: BofA Global Investment Strategy, EPFR

But with the Yen doing what it’s doing, being hedged was the way forward here. At the time of writing, it’s just gone through 160 vs the USD which is the lowest since 1990. Extraordinary things.

In the small cap space

Some brilliant news for a stock we’ve been following as well with Wellnex announcing they’ll be dual listing in London.

Source: Wellnex Life

Small moves in the Corporate space at the large end and the small end, showing that maybe, just maybe, we’re on the way back to the good old days.

If that’s the case don’t throw out some of those small caps you’ve been holding for a while because takeovers happen to be infectious.

Wine and dash

Finally here’s a guy who ran the London Marathon during a wine tasting. You just have to watch it. People are amazing.

https://x.com/jamescbriggs/status/1782453015795966426

All the best and stay safe,

James

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

Share Link