Morgan McGuire

- Mar 11, 2022

- 11 min read

Global Conflict & The Green Economy

Our Equities Trader, Morgan McGuire, discusses investing in renewables during war times.

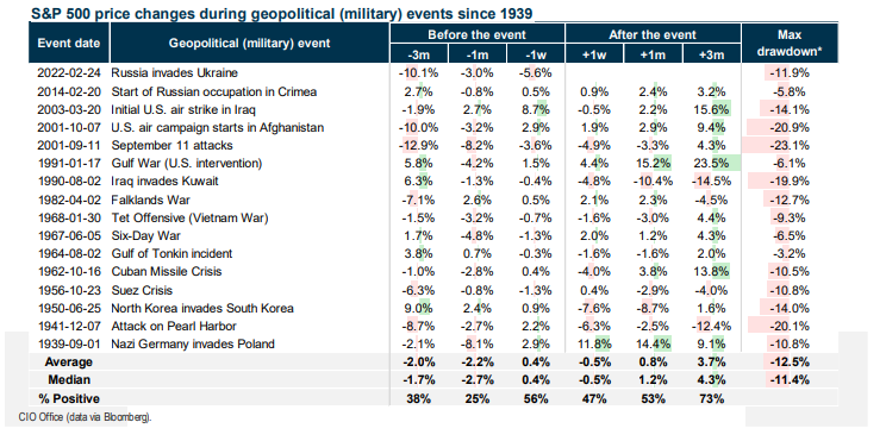

The Russia-Ukraine conflict has had significant implications on global markets. Geopolitical tensions, military posturing, and sanctions, allof which are causing economic turmoil, creating a level of confusion for many, making investment and trading choices difficult to navigate. Historical evidence suggests that post-conflict recovery is generally positive.

What I believe remains at the forefront for most countries, even during this tumultuous period in time, is the focus on tracking away from fossil fuel energy sources, towards renewable energy as a form of energy security. Transitioning to renewable energy is not an overnight solution there are many factors that need to be considered. Development and/or repurposing of infrastructure, retraining/upskilling the workforce, logistics and handling and storage of new energy and fuels, production costs, domestic and global governmental policies and legal frameworks and the list goes on. However, the movement towards renewables is taking shape and only gaining momentum each day.

A few examples that support, and give credence to this theory:

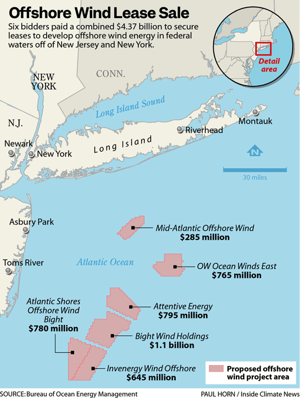

A record-breaking auction for the rights to develop offshore wind in federal waters off New York and New Jersey. The total of the winning bids was $4.37 billion for 488,000 acres spread across six lease areas. The process was overseen by the Bureau of Ocean Energy Management.

In addition to this record auction, private investment into U.S. clean-energy assets reached an astounding $105 billion last year (2021) as the country added an unprecedented amount of renewable-power capacity. The investment influx is 11% higher than 2020 and represents a 70% surge during the past five years, according to an annual report by BloombergNEF and the Business Council for Sustainable Energy. The private backing into U.S. assets including wind farms and solar plants represents about 14% of the $755 billion in global private investment made last year.

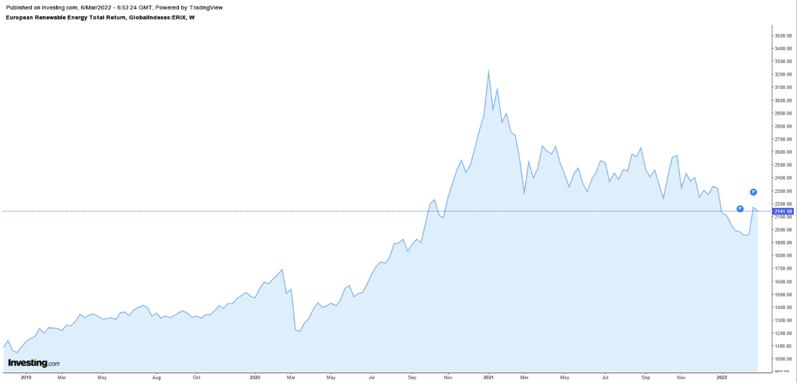

The European Renewable Energy Index (EREI), tracks the performances of European companies working in the renewable energy sector such as solar, water, biofuels, marine, wind and geothermal, surged nearly 9.3% in the last week of Feb 2022. Contrasting the steep decline during the pandemic. The need for energy security and reducing dependency on Russian based fossil fuels in the Northern Hemisphere has become drastically more apparent, reflected in the flow of capital towards renewables and the index’s sharp spike.

Since June 2021, India has seen an extraordinary surge in fuel costs. This has reintroduced the topic of energy security to the conversation. The fundamental focus of the conversation has been rising fuel consumption and reliance on imported crude oil for local requirements. The emergence of increasing global conflict, coupled with the risks of energy availability has led hydrogen fuel to being sought out as the premier alternative energy source and has driven drastic changes to governmental policy. Along with these changes is the private sector interest in investment into hydrogen production. Mukesh Ambani, the billionaire chairman of Reliance Industries, is planning to invest $75 billion in renewable energy infrastructure.

Bringing it back domestically, Viva Energy has announced the first New Energies Service Station will be built at the site of Viva’s existing petroleum refinery and will feature a 2MW electrolyser as well as hydrogen compression, storage and dispensing infrastructure. The $43.3 million project is supported by the Australian Government with $22.8 million through ARENA. Being the first public hydrogen refuelling facility in Australia, the project aims to support the uptake of hydrogen Fuel Cell Electric Vehicles (FCEVs) in heavy vehicles fleets in the Geelong region. Again, solidifying the idea of hydrogen as the next dominant energy source, tying in well with H2X Global’s Australian base in Victoria.

However, hydrogen is not the only commodity that Australia exports. Due to the current geopolitical and economic climate, Australia is poised in a uniquely advantageous position. We export and have most of the commodities that contribute to the green economy that other countries are dependent on importing; lithium, copper, graphite, manganese, to name just a few. There is a significant opportunity to capitalise on this. To learn more about the opportunities that are available in the present times, please contact me directly.

Here are some companies that are well-positioned to capitalise on the green economy during global conflict:

Infinite Blue Energy

Based in Perth, Western Australia, Infinite Blue Energy (IBE) is committed to leading the transition to a net-zero emissions economy by developing projects in Australia, Italy, and New Zealand to produce and deliver green hydrogen to domestic and export markets.

Renewable hydrogen is an emerging resource that will play an important role in decarbonising the world’s economy in the future with significant potential to be utilised in power grids for transport, infrastructure, and industry.

H2X Global

H2X Global is an Automotive and Power Unit Company founded on absolute sustainability. The Company is focused on the growing hydrogen fuel cell transport markets which are emerging in the key regions of China, North America, Europe, North Asia and Scandinavia.

H2X has established two key operating divisions within the Company to focus on the current market opportunity which exists in designing and delivering powertrain systems to heavy equipment and stationary power applications, as well as developing and delivering multiple light equipment vehicles using a proprietary H2X fuel cell and power train system which are set to enter the market in coming years as more hydrogen related transport infrastructure is established.

Talga Resources (ASX:TLG)

Talga Resources (ASX:TLG) is a battery anode and graphene additives company headquartered in Perth Western Australia and listed on the Australian Securities Exchange since July 2010. The Company is building a European source of battery anode and graphene additives, to offer graphitic products critical to its customers’ innovation and the shift towards a more sustainable world. Vertical integration, including ownership of several high-grade Swedish graphite projects, provides security of supply and creates long-lasting value for stakeholders.

Summary

Wartimes create confusion, despair, and opportunity. The world is in a period of significant change in multiple facets. The push for a sustainable approach to energy is ever-present and rapidly growing with ample opportunity for savvy investor. Many countries have mapped out their approach to decarbonisation, the private sector has been well advanced in this space and is now poised to capitalise on this transitionary phase in our human history.

Further Information

Read the Conversation:

Morgan McGuire:

“ The Russia, Ukraine conflict has had significant implications on global markets, geopolitical tensions, military posturing and sanctions, all of which are causing economic turmoil, creating a level of confusion for many, making investment and trading choices difficult to navigate. Historical evidence suggests that post-conflict recovery is generally positive.

What I believe remains at the forefront for most countries, even during this tumultuous period, is the focus on tracking away from fossil fuel energy sources, example that support and give credence to this theory are record breaking option for the rights to develop offshore wind in federal waters off New York and New Jersey, the total of the wind bids was 4.37 billion dollars for 488,000 acres spread across six *inaudible* areas.

Private investment into US Clean energy assets reached an astounding 105 billion last year in 2021, representing about 14% of the 755 billion in global private investment made last year alone. The European Renewable Energy Index surged nearly 9.3% in the last week of Feb 2022. Since June 2021, India has seen an extraordinary surge in fuel costs. This has reintroduced the topic of energy security to the conversation. The fundamental focus of the conversation has been rising fuel consumption and reliance on imported crude oil for local requirements. Hydrogen fuel is being sought out as the premier alternative energy source and has driven drastic changes to governmental policy.

Mukesh and Barney, the billionaire chairman of Reliance Industries, is planning to invest 75 billion in renewable energy infrastructure. And domestically, Viva Energy has announced the first new energy service station will be built at the site of Viva's existing petroleum refinery and feature a two megawatt electrolyzer, as well as hydrogen compression, storage and dispensing infrastructure.

The 43.3 million dollar project is supported by the Australian government with 22.8 million through arena. However, hydrogen is not the only commodity that Australia exports. Due to the current geopolitical and economic climate, Australia is poised in a uniquely advantageous position- we export and have most of the commodities that contribute to the green economy that other countries are dependent on importing: lithium, copper, graphite, manganese, to just name a few. There is significant opportunity to capitalise on this. To learn more about investment options that are available in the present times, please contact me directly or click the link in the description.”

Where to from here?

Trading equities is all about having access to the right investment opportunities and making decisions based on accurate, unbiased information. Often, this means hours of research on a daily basis, keeping up with several ASX announcements, understanding economy-impacting events and regularly consuming broader news updates. If you're not an equities trader by profession, then it can quickly become rather overwhelming, especially once you have built a considerable-sized investment portfolio.

Our Equities Trading team, backed by our independent research department is the ideal solution for said situation. Our clients receive access to exclusive investment opportunities, daily ASX research reports, our expert weekly outlook on the Australian markets and direct access to our equity traders.

Trading with Barclay Pearce Capital is about building long-term returns, trust, confidence and a mutually beneficial relationship.

Trading with Barclay Pearce Capital ensures the needs of investors of all magnitudes are met by our highly skilled and attentive trading professionals.

~ Trent Primmer, Director of Trading, Barclay Pearce Capital.

Share Link