Jack Colreavy

- Nov 7, 2023

- 5 min read

ABSI - Japan is the Canary in the Coalmine

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

On Melbourne Cup day all eyes will be on the RBA to see if the new Governor defies political pressure to raise rates from the current 4.1% to counteract a recent resurgence of inflation in Australia. Consensus is for a 25 bps increase, but it isn’t a lock,and Michele Bullock could surprise the market just like the Bank of Japan (BOJ). Last week the BOJ continued to hold the cash rate at negative 0.10% despite a sustained uptick in inflation. ABSI will dissect the issues with Japanese monetary and fiscal policy.

The BOJ met last week for their monthly monetary policy meeting with the outcome being no change in the cash rate, which will remain at the record low of negative 0.10%. This continues to surprise many economists given the traditionally deflationary country has seen a sustained increase in inflation above 2% for the past ~2 years, though it hasn’t gotten out-of-control like other western countries.

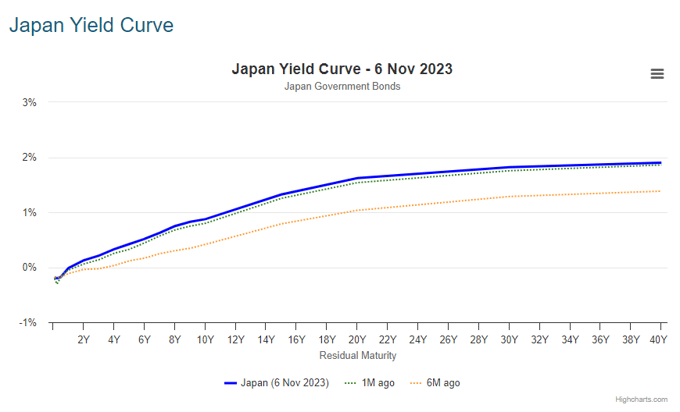

What was most interesting from the meeting was the decision to allow more flexibility in its yield curve control. Historically they set a 0% target on 10y bonds and would intervene in the market (buying bonds) to ensure it stayed there; also known as quantitative easing. This resulted in an explosion of the BOJ’s balance sheet. As a result, they allowed a 0.5% range in Dec 2022 to minimise the interventions, which was increased to 1% in July 2023. Last week they removed the 1% upper limit and now use that level “as a reference”...whatever that means.

Source: World Government Bonds

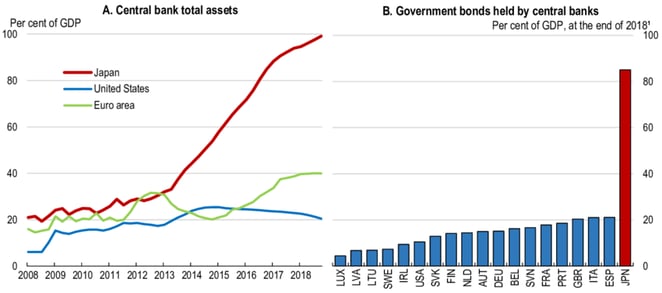

This quantitative policy has seen the balance sheet of the BOJ explode over the past two decades, eclipsing the rest of the developed world on an asset to GDP ratio. The latest figures from the BOJ have assets totalling ¥750.6 trillion against an estimated GDP of ¥558.6 trillion which gives a 134% ratio. As a comparison, the US has about a 33% ratio. By far the biggest asset on the BOJ balance sheet are Japanese government bonds (JGB) which total ¥594.8 trillion. In the month of October alone, this balance increased by almost ¥8 trillion or ~US$53.3 billion. This unsustainability of the bond buying program is why the BOJ needed to relax the policy.

Source: Research Gate

I don’t see the BOJ unwinding the balance sheet anytime soon but there is an expectation for them to start looking at increasing the cash rate as inflation becomes more entrenched. Importantly, the timeline for this may be brought forward by the Japanese government’s decision to fight inflation with a ¥17 trillion stimulus package. Obviously Prime Minister Kishida didn’t see the Great British trainwreck last year that sank Liz Truss.

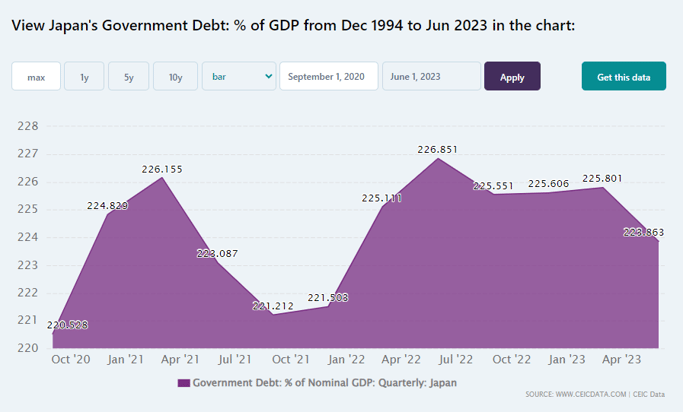

The stupidity of this policy decision is beyond comprehension. Here you have the world’s most indebted economy (224% of GDP) that is in fairly good shape with 1.6% GDP growth, 2.6% unemployment, and a negative cash rate. Instead of running a fiscal surplus to attempt to get government finances under control, they decided to continue to run massive deficits and hand money out like it’s 2020. This policy will stoke the fires of inflation and may force the BOJ to raise rates sooner than the current expectations of April 2024.

Source: CEIC

Source: CEIC

While this is good news for the Japanese Yen, which has been destroyed by the monetary policy decisions, it will be bad news for the Japanese government debt. According to the April Japanese public finance fact sheet, the government will spend 22% of its budget on national debt service in FY23. That is a large portion of the budget that is set to go a lot higher considering the volume weighted average fee for JGBs is just 29 bps. If the BOJ decides that it needs to raise rates in order to fight inflation, this expense could spiral out of control. The total value of JGBs outstanding is approximately ¥1.2 quadrillion and at 4% the interest bill would be ~¥50 trillion or almost 50% of the current federal budget.

At the end of the day, these are all speculations. For all I know, the BOJ may let inflation run to 10% before intervening in the market because they know that higher rates will be devastating to government finances while high inflation is good for debt holders. Or inflation may just stay at 2% given the negative demographic trends and the propensity for the Japanese to save. All I can say for certain is to watch this space.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link