Barclay Pearce Capital

- Feb 5, 2024

- 7 min read

Market Map with James Whelan - A Little Bearish Perhaps...

New job, new firm but the same Free Whelan. Thank you for your continued support and keep unlocking valuable insights into the global market every week with me!

Good afternoon,

It was over the weekend that I was informed by my amazing wife that Woolies was short on strawberries. Zero strawberries. I was thinking that after all the hullabaloo around price gouging by people who don’t understand seasonality or margins “what if it was possible that Woolies literally decides NOT to put things on the shelves simply because the price has to be too high and they don’t want the negative publicity?”

An interesting thought, that the pearl-clutching about the amount Woolies charges for food is actually means less food hits the shelves.

An hour later I was informed that strawberries were in fact back in prime position for ~$3.50 a punnet. So no.

But I think we all had fun entertaining the idea in the Whelan house on a busy Saturday morning. Also if you think (as I do) that the Australian economy is weaker at a personal level than it’s currently perceived, then supermarkets usually do ok in those environments.

Regarding inflation, there’s something I need to remind people often is that as we all slap each other on the back crediting that we’ve beaten inflation as the rate comes down back towards the holy 2% mark. That doesn’t mean prices are coming off. It just means they’re rising less higher than what we’ve seen. I think that in the self-congratulatory applause, we have lost the audio screaming at us that “2% inflation is still inflation!”

Which isn’t all that bad…but just don’t ask the question too loudly why prices for many things aren’t going backwards.

A little note from Goldman Sachs research is that a $10 rise in Brent crude equates to around 20-25bps worth of consumer inflation in the US (PCE to be exact). The oil rally is not good for the hip pocket, which isn’t exactly new news.

Now on to the fun stuff.

New month, new stats. And we’re emboldened by the fact that in every past market instance in the US when the S&P was up in January it’s just about always a bullish year.

We cover this in the latest iteration and return for 2024 of the Theory of Thing podcast.

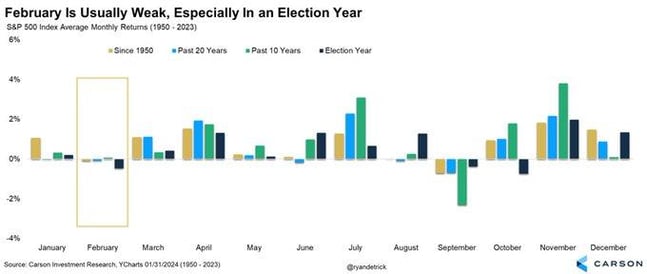

February is a relaxing month. And Frankie says Relax.

Source: Carson International Research, YCharts 01/31/2024(1950-2023)

Keep in mind that tech continues to drag the US market northward and nothing else really matters. However maybe without the tailwind of seasonality, you should pay attention to the flashing lights.

Earnings & Valuations…

Look past the “Magnificent 7” (the mag 7 as it’s being known) and you get a picture. The Russell 2000 is notoriously ordinary for earnings but 52% is a significant Quarter on Quarter decline.

Source: Gordon Johnson - X

That’s real companies that are, allegedly, the backbone of the US economy.

The US Economy is booming, however, and I’m cutting this right out of our morning report which you can sub for here:

The government reported the U.S. economy added 353,000 jobs in January, well above the Dow Jones estimate from economists of 185,000. The report also included inflationary data in the form of greater-than-expected wage growth. Wages expanded by 4.5% year over year, more than a 4.1% forecast. The US unemployment rate remained at 3.7%, lower than forecasts which were looking for a slight increase to 3.8%.

That is an economy that’s booming, with the big (and small) tech stocks letting people go, while small-cap earnings are woeful.

You put that together and you have a bit of a messy picture.

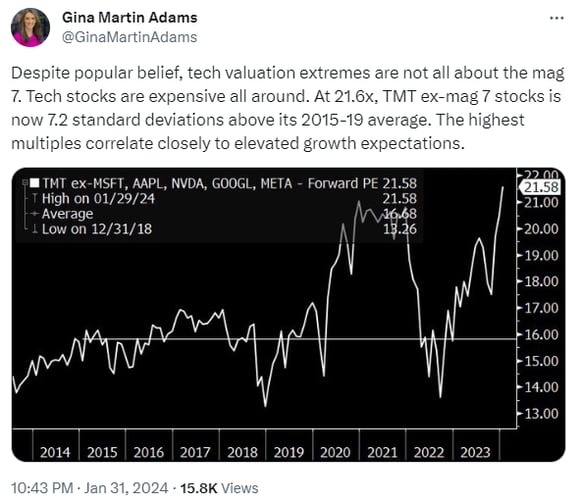

Bloomberg’s Chief Equity Strategist had this the other day on the Tech, Media and Telecoms sub-sector valuations EX the Mag 7.

Source: Gina Martin Adams - X

That’s a long way off averages and requires a LOT of growth to make the other side of the equation catch up.

And Powell shot down any chance of a sooner rather than later rate cut expectation last week, along with those jobs numbers…

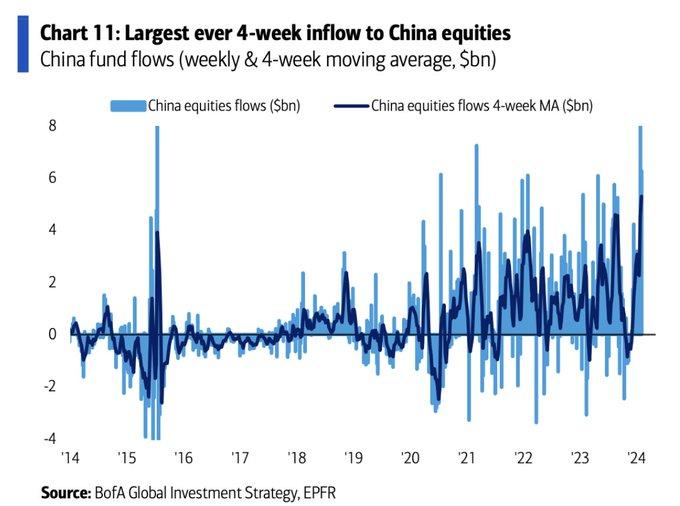

And if you want somewhere to take a small profit (because it’s all about staying invested) then you can join the absolute mess of the China market, which is not only seeing record inflows…

Source: BofA Global Investment Strategy, EPFR

But is also seeing record flows OUT of China into foreign ETFs at the largest monthly amount since late 2020.

Money going in, money coming out... I still like China in smalls as a deep-value play. Close your eyes.

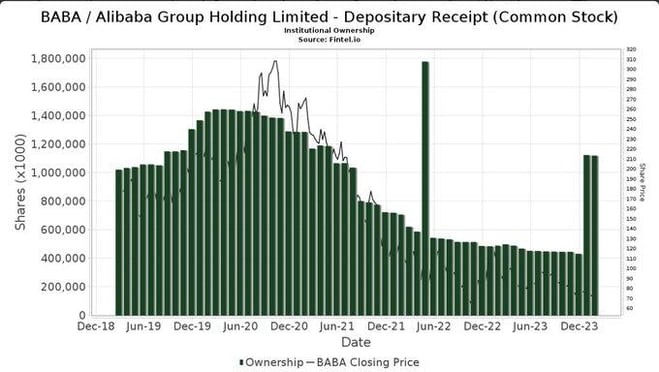

Source: Fintel

That in mind, insto ownership of Alibaba has been increasing rapidly leading into earnings on Wednesday (US time). Pay attention.

Last thing…almost

Zuck was absolutely slammed last week by Congress. You know I’ve been following this and I feel that Meta and its related platforms are about as close to evil as you can get (says me, who just figured out how to monetise his Insta account…)

But here’s Ted Cruz tearing them apart nicely

And here’s what happened to Meta stock last week with the announcement of earnings, buyback and a new divvy.

Source: TradingView

That’s why you don’t short the big names.

Finally a collection of idiots with the new Apple Vision Pro,

Source: Bojan Tunguz - X

Source: Tech AU - X

Source: Tech AU - X

Stay safe and all the best,

James

Share Link