Roberto Russo

- Mar 8, 2022

- 5 min read

Technical Analysis - War Time

Our Equities Trader, Roberto Russo, discusses Technical Analysis during this war time period.

It is no secret that war makes money.

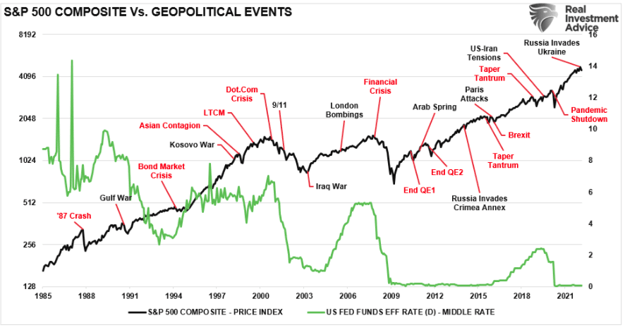

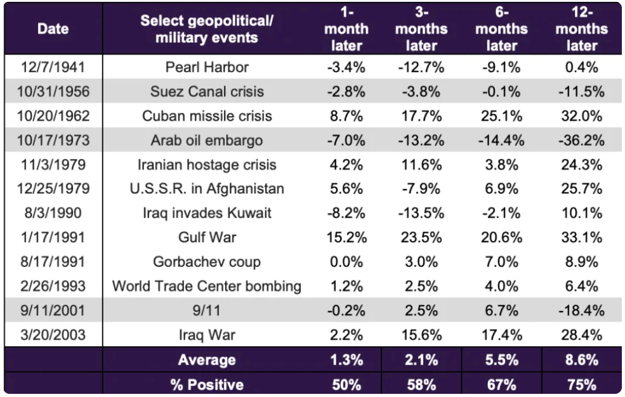

This has posed one of the biggest moral and social dilemmas people face during these periods of time. The chart below shows how the index has performed during specific conflicts:

Source: Real Investment Advice

Source: Real Investment Advice

Source: Yahoo Finance

Source: Yahoo Finance

After some initial setbacks, once the conflict or war is declared, the indexes go on to outperform and return sustainable gains in the foreseeable future.

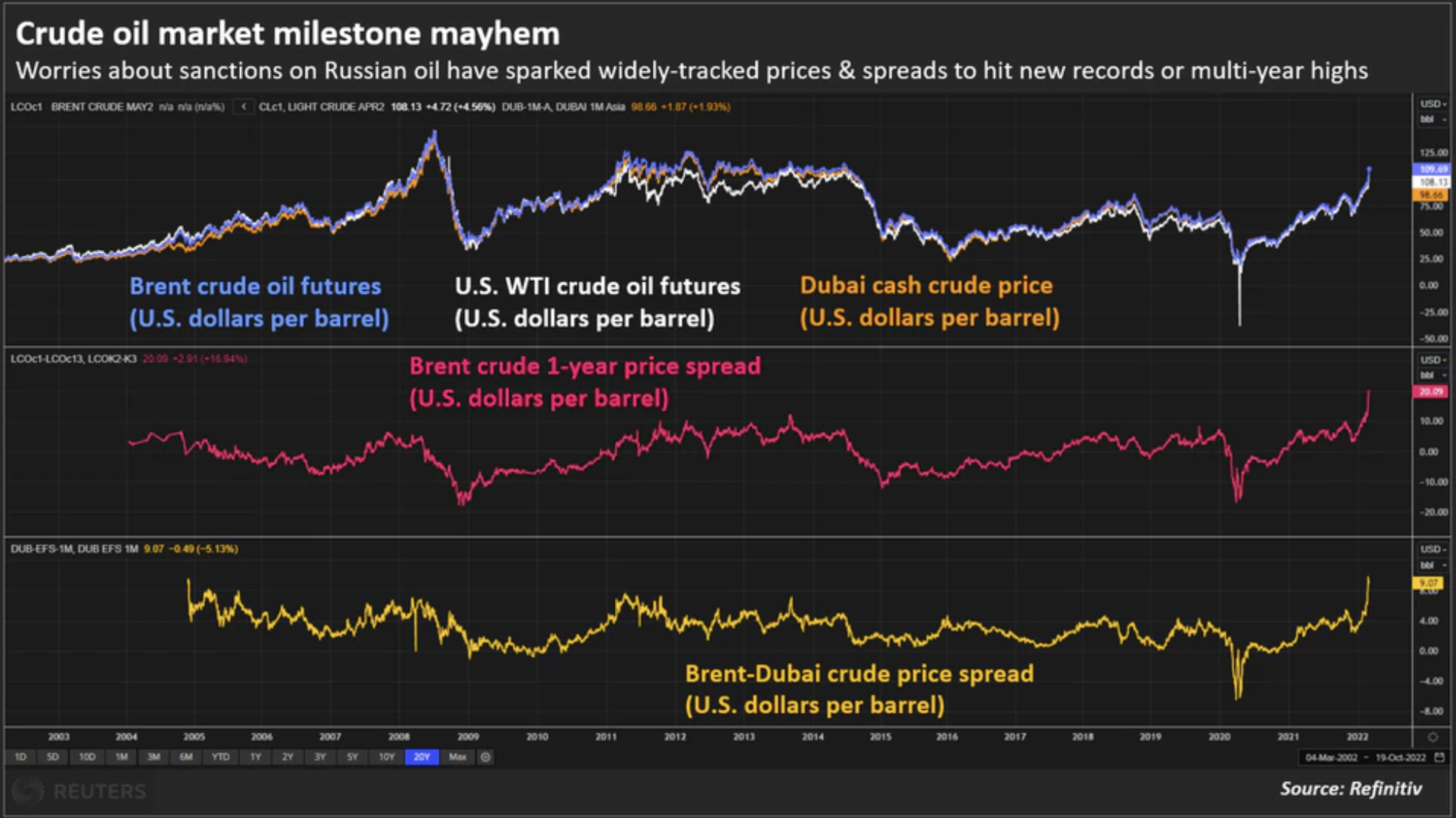

Let's use the Russian-Ukraine conflict as an example. The chart below is how the price of oil has moved as of late:

Source: Reuters

In short, with higher prices, the major producers are set to benefit from the overwhelming demand for non-Russian crude oil, therefore pushing the price per share of companies like Woodside Petroleum (ASX:WPL) and Beach Petroleum (ASX:BPT) in a dramatic upwards move.

Woodside Petroleum Limited (ASX:WPL)

Russia also accounts for a 40% global supply in palladium, 10% of the supply of nickel, and a 6% supply of aluminium, forcing the spot prices upwards and thus, the commodity producers following suit.

Palladium Futures (PA1!)

The demand for commodities was quite high before the conflict began, now with sanctions and logistical issues around Europe, we are seeing a snowball effect play out for the base and precious metals, with producers reaping the rewards.

The demand for commodities was quite high before the conflict began, now with sanctions and logistical issues around Europe, we are seeing a snowball effect play out for the base and precious metals, with producers reaping the rewards.

Nickel Mines Limited (ASX:NIC)

The conflict seems to be lasting longer than most people may have expected it to, putting constant pressure on the XAO (ASX All Ords) and the DJI (Dow Jones) indexes as people look to minimise their growth stocks and look for safer alternatives, what's mainly cash focused.

Summary

Whilst having liquidity available is always a good thing, cycling a portfolio to take advantage of the current situation presents a great opportunity to make short-term trades that potentially mitigate any growth losses.

Where to from here?

Trading equities is all about having access to the right investment opportunities and making decisions based on accurate, unbiased information. Often, this means hours of research on a daily basis, keeping up with several ASX announcements, understanding economy-impacting events and regularly consuming broader news updates. If you're not an equities trader by profession, then it can quickly become rather overwhelming, especially once you have built a considerable-sized investment portfolio.

Our Equities Trading team, backed by our independent research department is the ideal solution for said situation. Our clients receive access to exclusive investment opportunities, daily ASX research reports, our expert weekly outlook on the Australian markets and direct access to our equity traders.

Trading with Barclay Pearce Capital is about building long-term returns, trust, confidence and a mutually beneficial relationship.

Trading with Barclay Pearce Capital ensures the needs of investors of all magnitudes are met by our highly skilled and attentive trading professionals.

~ Trent Primmer, Director of Trading, Barclay Pearce Capital.

Share Link