Market Insider

- Apr 14, 2020

- 2 min read

The Benefit of Capital Raisings Part I

Market transactions can be very beneficial to your portfolio's return's.

The ASX is starting to see a flurry of capital raising’s for companies in need during a time of uncertainty. Conversely, companies that aren’t fairing too poorly have also been quick to strike and raise capital to fund expansion. One’s lifeline is another’s opportunity.

An example of this was the recent equity raising for Next DC ($NXT) that quickly raised $672 million at $7.80 (a 15% discount to the last traded price). The returns for participants were outstanding.

- The stock went into a trading halt pre market on Wednesday the 2nd of April, and announced that it was raising capital.

- It took Thursday off the boards.

- Friday it resumed trading. Opened at $9.69 (a 24% return to participants) and reached $10.40 (a 33.33% return to shareholders in 2 days) before closing at $9.20

Whilst this company, and its sector, Data Centres, is well positioned in the economic climate, let’s look at an industry brutalised by COVID19; travel.

Webjet ($WEB), a stock unambiguously slaughtered by the Coronavirus (trading down -70%), also experienced stunning returns for its capital raising.

- On Thursday the 19th of March it announced to the market a pause in trading.

- It sought to tap the market for $275 million of fresh equity.

- By April 2nd the company stated it had raised $346 million at $1.70 per share.

It resumed trading on the 2nd and opened at $3.00 (a 76% return) before touching $3.49 (a 102% gain) before closing at $2.78.

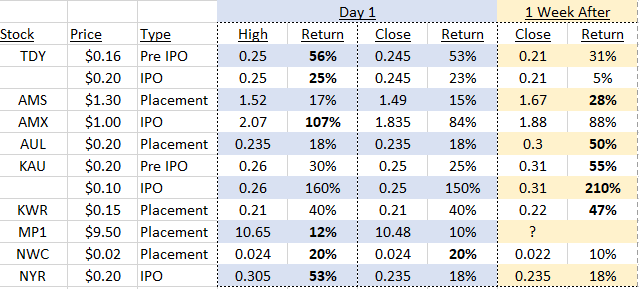

And it is not just this environment that provides out sized returns for investors. A list of transactions recently offered to Barclay Pearce Capital Clients

These numbers annualised would be very large. In the last week we have seen a handful of placements and they have all provided great opportunities for investors.

Remember, in markets like these, be quick, stay nimble. If you are interested in the flurry of on-market deals coming across our desk subscribe to our 'Deal of the Week' here.

Share Link