Morgan McGuire

- May 23, 2022

- 11 min read

The Decarbonisation Roadmap & Our Changing Global Landscape

Our Equities Trader, Morgan McGuire, discusses the changing geopolitical, environmental and social landscape and its influence on decarbonising our economy.

We tend to throw around the word unprecedented a lot lately. The feeling that certain events are unprecedented can be easy to agree with on an emotional level. However, the unprecedented experiences in my view can be somewhat explained by the fact that our current generation(s) and maybe 1 or 2 ahead of us have not experienced the level of change we have in our adult lives at present. The events that reshape the world have been events that other generations have lived through and etched a mark in our human history.

Over the past 2 years, we have seen a dramatic shift in our world. Here in Australia, it’s easy to forget the 2019 bushfires that claimed lives and livelihoods. We were not to know that was the only precursor we could have imagined at the time, as a dystopian world in sci-fi fantasy. The world was gripped in a global event that had not been seen since the past 10 worst global pandemics.

Perhaps we need to be forgiven for taking for granted the experiences our parents and grandparents went through when there were world events reshaping their known reality. It’s easy to dismiss what you have never really experienced firsthand, or that which has not had a significant impact on your life. Fast forward to 2022, we are amid a growing sense of recession and with that comes the different emotional responses to that threat, be it fear, panic, anger or a sense of opportunity?

Technology

There have been drastic (r)evolutions in technology, which have been growing at such an exponential rate, that it seems even Moores Law can’t keep up! It has been estimated that 90% of the world’s data has been generated in the last couple of years alone. We have seen the emergence of blockchain technology, giving rise to cryptocurrency. We have social media influencers, which have given rise to finfluencers taking hold and adding weight to the perspectives of people on their financial journey. What further role technology that is yet to be unveiled will play on the financial landscape in the future is anyone’s guess.

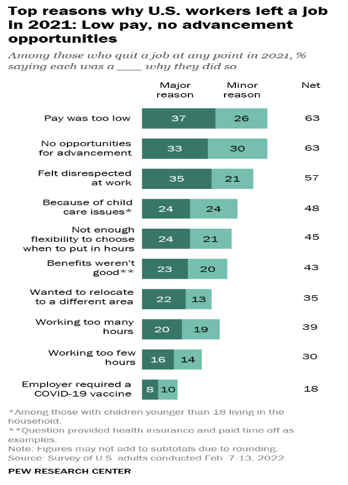

Cryptocurrency, traditional markets job satisfaction

The emergence of crypto millionaires over the past decade, combined with the lockdowns that ensued over the past 18-24 months has led to people rethinking their path to financial security or independence, specifically relating to their investment choices and employment. We have witnessed the onset of The Great Resignation in the US, UK France and Australia. Reasons for which, are regularly debated and have multiple potential catalysts.

The emergence of crypto millionaires over the past decade, combined with the lockdowns that ensued over the past 18-24 months has led to people rethinking their path to financial security or independence, specifically relating to their investment choices and employment. We have witnessed the onset of The Great Resignation in the US, UK France and Australia. Reasons for which, are regularly debated and have multiple potential catalysts.

Anecdotally, we have seen an increase in market participation from those who may not have considered entering the market, who are now holding positions. Those who may have invested in cryptocurrencies are now open to the stock market and vice versa. We saw a fundamental shift during the GameStop retail trading takeover of wall street that took place in 2021. Providing recognition of investment opportunities in traditional markets to a whole new generation that may otherwise have not looked into market participation.

Instant Gratification

There is an epidemic of instant gratification in a lot of aspects of modern life, take music for an example. No longer do we even dream of waiting for a new album at a music store. We can have all the music, ever created, at our fingertips. Dating, people can literally swipe their fingers on their phone and be connected with someone who is willing to date. Food can be delivered to whichever location you are that can be easily reached. Why would we be willing and patient enough to wait for anything? The need for immediate results loosely translates to the ROI anxiety (generally speaking) and expectations in the traditional markets. The current bull market that started in March 2009 is the longest bull market in history. It's topped the bull market of the 1990s that lasted 113 months investors have become somewhat accustomed to seeing near term results in just about any sector. With the bull market officially coming to a head we are seeing the backlash of the result expectancy that has been the normality for the better part of a decade.

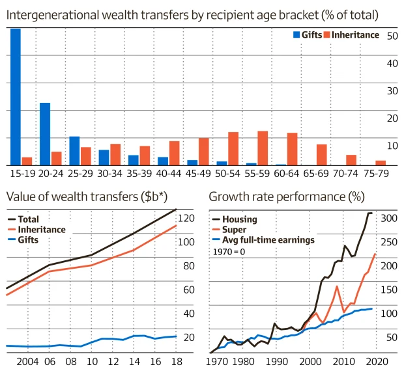

Wealth Transfer

What is also taking place simultaneously, along with all the above-mentioned topics, is the largest intergenerational wealth transfer in history. Wealth is being passed on from the wealthiest generation which, according to BlackRock, is the baby boomers. Baby Boomers are considered those born around 1946 and 1964, to the millennials presently aged around 25 to 40 years. Generations are social constructs. No natural law distinguishes people born between 1946 and 1964 from those who came before or after. Too often, generational analysis elicits class divisions or veers into the astrological (per McKinsey, millennials are “questioning” individuals who value “experience,” while zoomers are “communaholics” who prize “uniqueness”). It is estimated that, Across the wealth spectrum, Millennials will inherit in Australia alone Approximately $3.5 trillion over the next two decades, with baby boomers and the World War II generation to leave record levels of wealth to Generation X and older Millennial beneficiaries equating to an average of $320,000 per person. The financial industry is recognising the need to be prepared for the significant changes in the transfer of wealth, approaches to investment, and the expectation of advisors.

Ethical Investment

Morgan Stanley Bank conducted a survey recently which found nearly 90% of millennial investors were interested in pursuing investments that more closely reflect the values they hold. Both two largest ETF providers – BlackRock and Vanguard – offer clients a choice of ESG-focused funds. BlackRock added six new ESG funds in 2020 alone. The movement is real, and it is seemingly more apparent to businesses that they need to align with this requirement or be left behind in market share.

Ethical Investment

ESG - is an approach to evaluating the extent to which a corporation works on social goals that go beyond the role of existing purely for profits. How they are providing positive contribution as a global citizen.

There is growing obligations and expectations on companies to adhere to the Environmental Social and Corporate Governance Principals (ESG). At present it can be argued that the focus it seems for most entities is the E in ESG. The focus is not solely driven by policy or legal framework changes. In fact, ESG investing, despite the criticisms, is becoming increasingly popular and is most likely to be an investing approach used by millennials. As market businesses and governments begin to develop policies and legal instruments to manage this transition.

Summary

The economic, geopolitical, and environmental landscape is ever-changing. Coupled with significant technological advances, emerging social media identities influencing investment and wealth creation journeys. The battle between investing in cryptocurrency and traditional markets, along with the general desire for instant gratification is leading to interesting choices being presented for investors within the financial world. The pressure on governments, companies, and the financial sector to make ethical and sustainable decisions is growing more and more complex. The path for investment into the green economy is becoming more clear with an abundance of emerging opportunities.

Opportunities

With all that is taking place in the rapidly changing global landscape and the emerging green economy. The obligation for the financial sector, governments, companies, and investors to take ownership of their ESG responsibilities and contributions is more apparent than ever. A few companies that are aligned with these principles are:

Synergen Met

Synergen Met is an Australian based thermal plasma technology specialist. Synergen Met uses technology to create sustainable solutions to environmental problems. Consisting of a multinational business, made up of a team of the best scientific minds, who have more than 150 years of collective experience working in the global mining, engineering, sustainability and renewable sectors. Synergen Met is committed to using our technology to ensure the continuous betterment of the global environment to support future generations.

Infinite Green Energy

Based in Perth, Western Australia, Infinite Green Energy (IGE) is committed to leading the transition to a net-zero emissions economy by developing projects in Australia, Italy, and New Zealand to produce and deliver green hydrogen to domestic and export markets.

Renewable hydrogen is an emerging resource that will play an important role in decarbonising the world’s economy in the future with significant potential to be utilised in power grids for transport, infrastructure, and industry.

H2X

H2X Global is an Automotive and Power Unit Company founded on absolute sustainability. The Company is focused on the growing hydrogen fuel cell transport markets which are emerging in the key regions of China, North America, Europe, North Asia and Scandinavia.

H2X has established two key operating divisions within the Company to focus on the current market opportunity which exists in designing and delivering powertrain systems to heavy equipment and stationary power applications, as well as developing and delivering multiple light equipment vehicles using a proprietary H2X fuel cell and power train system which are set to enter the market in coming years as more hydrogen related transport infrastructure is established.

Further Information

Where to from here?

Trading equities is all about having access to the right investment opportunities and making decisions based on accurate, unbiased information. Often, this means hours of research on a daily basis, keeping up with several ASX announcements, understanding economy-impacting events and regularly consuming broader news updates. If you're not an equities trader by profession, then it can quickly become rather overwhelming, especially once you have built a considerable-sized investment portfolio.

Our Equities Trading team, backed by our independent research department is the ideal solution for said situation. Our clients receive access to exclusive investment opportunities, daily ASX research reports, our expert weekly outlook on the Australian markets and direct access to our equity traders.

Trading with Barclay Pearce Capital is about building long-term returns, trust, confidence and a mutually beneficial relationship.

Trading with Barclay Pearce Capital ensures the needs of investors of all magnitudes are met by our highly skilled and attentive trading professionals.

~ Trent Primmer, Director of Trading, Barclay Pearce Capital.

Share Link