Jack Colreavy

- May 24, 2023

- 4 min read

ABSI - Rs2,000 Note Withdrawal in India

Every Tuesday afternoon we publish a collection of topics and give our expert opinion about the Equity Markets.

The Reserve Bank of India (RBI) last Friday surprised markets by pulling the Rs2,000 note, its highest denominated note, from circulation by September of this year. While analysts claim the move would ripple through business, the RBI counter that the notes only account for 10% of currency in circulation and were not commonly used for transactions anymore. ABSI this week reviews the situation and looks back to 2016 for clues on the market reaction.

When analysing the situation, it is important to appreciate that there is a recent precedent when in November 2016 Prime Minister Narendra Modi unexpectedly demonetised the Rs500 and Rs1,000 notes. The scheme invalidated the notes and replaced them with new Rs500 and Rs2,000 notes. The decision was primarily taken to combat issues such as corruption, black money (undeclared income), counterfeit currency, and the funding of terrorist activities in the country. There was also an objective to create a "less-cash" economy by promoting digital transactions and formal banking channels.

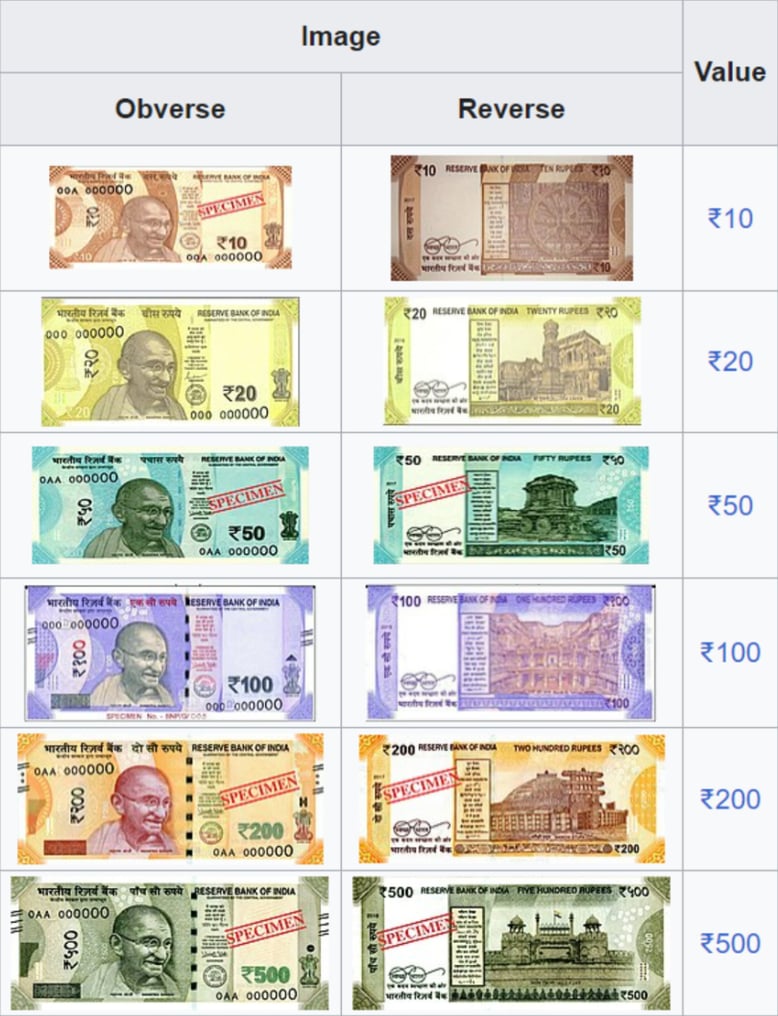

Indian Bank Notes in Circulation

Source:Wikipedia

One of the primary criticisms of the policy was the challenges for unbanked people. The sudden withdrawal of notes created a cash crunch, and individuals without bank accounts faced difficulties in exchanging their invalidated notes. Ultimately, this short-term challenge resulted in efforts to promote financial inclusion and open bank accounts for unbanked individuals such as the use of mobile banking and simplified digital payment options to make them more accessible to the masses.

Despite these challenges, after the demonetisation in 2016, there was a significant increase in bank deposits in India. The move led to a massive influx of old currency notes being deposited in banks as people rushed to exchange their invalidated notes for new currency or deposit them into their bank accounts. Importantly though the increase in bank deposits does not necessarily represent an increase in legitimate or taxable income. Some portion of the deposits were from black markets which required the government to implement measures to identify suspicious or unexplained deposits and take appropriate actions.

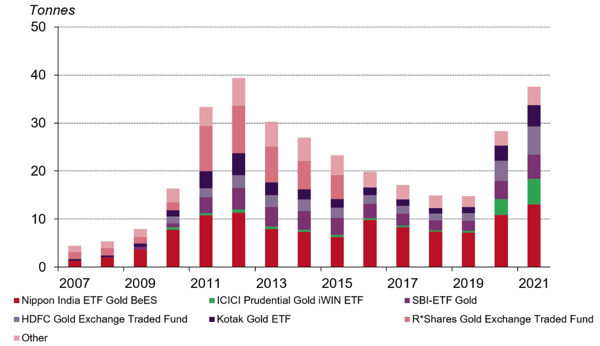

Holdings of Indian gold ETFs on Indian exchanges

It is important to appreciate the cultural affinity Indians have for gold. Part of that love for gold is its use as a store of value and inflation hedge; so much so that idle gold held by individuals has been put to productive use through the Indian government the Gold Monetization Scheme. This scheme allows individuals to deposit their gold with banks, earn interest on the deposit, and later redeem it in either physical gold or cash. However, many also use gold as a means to bypass the banking system completely with a surge in the domestic gold price after the demonetisation announcement in 2016.

As we fast forward to 2023 with the removal of the Rs2,000 note we can confidently assume the move will have both positive and negative consequences. While there may be a short-term disruption in the economy and inconvenience to the public, the government expects long-term benefits in terms of increased tax compliance, reduced corruption, and an expedited shift towards a digital economy. As always there will be many who try to circumnavigate the system and this will occur through the trading of hard assets, particularly gold and other precious metals and gems.

We offer value-rich content to our BPC community of subscribers. If you're interested in the stock market, you will enjoy our exclusive mailing lists focused on all aspects of the market.

To receive our exclusive E-Newsletter, subscribe to 'As Barclay Sees It' now.

Share Link