Barclay Pearce Capital

- Mar 25, 2024

- 6 min read

Central Banks, Commodities & Recession Signals - Market Map with James Whelan

New job, new firm but the same Free Whelan. Thank you for your continued support and keep unlocking valuable insights into the global market every week with me!

Theory of Thing Podcast

We had Pepperstone's Chris Weston on the pod this week and it's a lot of fun. So many central banks out with directions last week and we pick it right apart. Some chatter around commodities too. He's very smart and I love having him on the show. Please enjoy!

Listen to the podcast:

Congratulations, we have now been a part of the longest consecutive streak of trading days with the US 10/2s curve in an inverted pattern.

Keep in mind this is one of those Nostradamian (new word) signals that predicts a recession. It even predicted a recession before the COVID recession, which was weird.

It's been predicting a recession now since the middle of June 2022, and with a very springy US economy and accommodative Fed, it's difficult to see where it's going to come from.

Source: Barchart - X

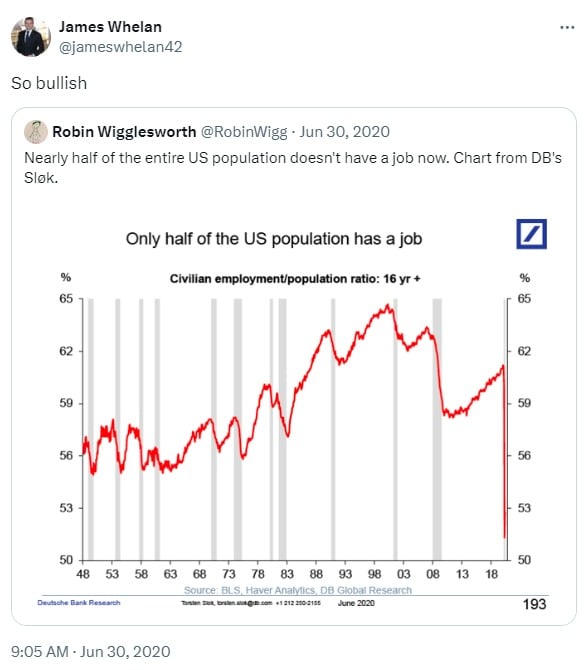

Speaking of things not making sense I was alerted to one of my responses to one of the FT's global finance correspondents when Covid was at its absolute June 2020 craziness.

Source: Robin Wigglesworth - X

Strange to think that the impact of half US population over 16 not having a job was what, indirectly, drove markets higher.

Now, with about the most robust labour market in a few generations, the market is still ploughing ahead.

Not many other ways to say "remain invested" than that.

Europe

With the attention mostly on the Us and the magnificent 7 (i.e. NVDA) hogging all the spotlight many have missed what's going on in Europe. Absolute carnage over there.

Kidding, the main Index is tracking 11 straight weeks of gains. I'm trying to minimise the number of graphics I use in these notes but imagine an ETF called ESTX which is the Eurostoxx 50 managed by my buddies at Global X which is tracking straight up and there you have it.

Specifically, if you're still searching for value then European Financials might be the way forward. The latest podcast by Morgan Stanley takes the best parts of the recent European Financials Conference by their Euro guys on the ground.

They say this on wealth: "Wealth may not recover already in Q1. But as the confidence builds up, we definitely expect inflows to pick up in the second half, both in quantity and margin....We continue to be positive in the sector. Look, the valuation is depressed. The multiples, the PE multiples on six times. Historically it's been much closer to double-digit. We think recovering PMIs should help re-rate that multiple."

So if it's the European Financials ETF you're after then you need to travel overseas for iShares MSCI Europe Financials ETF EUFN. And yes it's trading on a lower P/E than usual with a dividend to keep you warm at night waiting on those PMis.

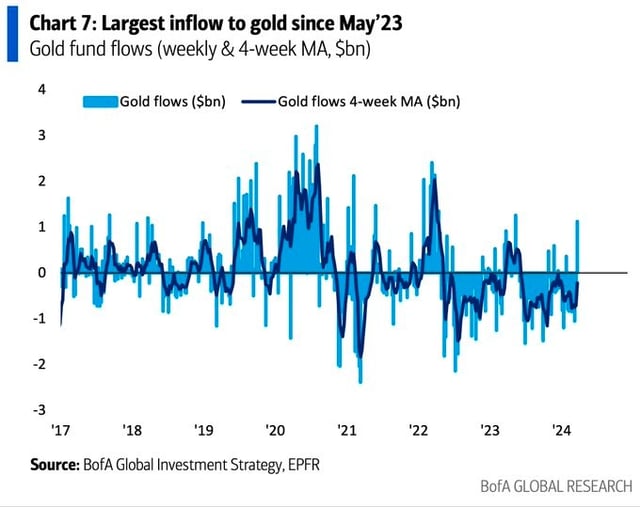

Gold

Don't sleep on gold. Biggest fund inflows since May last year.

Source: BofA Global Investment Strategy, EPFR

That's not nothing.

There are some lovely little gold miners out there just waiting for some love and having just spent two days at a mining conference last week I can tell you there are some micro caps that have some decent gold holdings. Message me to find out which ones.

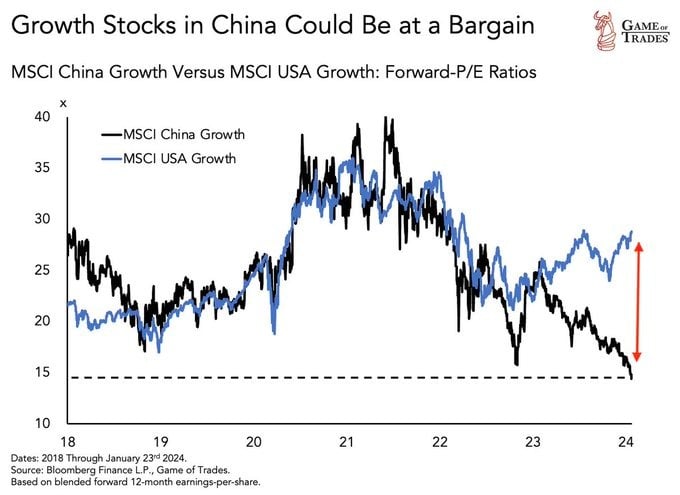

China

I continue to push the barrow on China and for those looking to diversify out of the US (which should be everyone if you believe in diversification) then China is now ultra-cheap on a relative basis.

Source: Game of Trades - X

We continue to favour CETF as the best way to gain exposure locally to China.

Stay safe and all the best, our thoughts are with Princess Kate and her family,

James

A quick detour to announce the BPC NRL Tipping Competition!

Welcome to the BPC NRL Tipping Competition for 2024. The season has kicked off with a bang in the glittery lights of Las Vegas. Panthers are favorites to take the crown again but the Broncos look like a formidable opponent to take revenge from the heartbreak of 2023. BPC loves its footy and we're very excited for the season ahead. We also love to win stuff so please keep an eye out for the prizes on offer. Sign up and join the game!

Share Link