Market Insider

- Apr 17, 2020

- 3 min read

The Benefit of Capital Raisings Part II

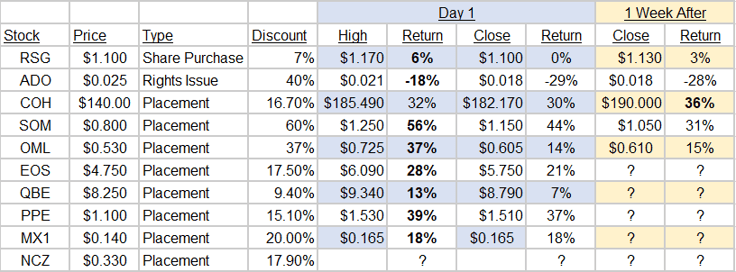

There are winners, and there are losers.

*close prices at time of publishing

Recently I wrote about 'the quick profits being made in the market' through capital raising’s to some response, the Street doesn’t look to stop rattling the tin anytime soon. Whilst the barrage of capital raising’s coming to the market provides a great opportunity for short term profits, unfortunately for those already in the stock, you are averaging down and therefore likely underwater. At times of uncertainty I have heralded ‘keeping some powder dry’ (and a range of other cliches) in order to turn quick profits. The hardest part is assessing if this stock comes back. If you are not involved in a stock and it goes to raise; it’s time to cash in.

This week the S&P/ASX 200 Index rallied 1.9 per cent on Tuesday, ending the day 942.1 points, or 20.7 per cent above its March 23 low, marking its entry into bull market territory. On Tuesday night, two of the FAANG stocks made all time highs. Not highs for the year, all-time. What a weird time.

Private equity is even eyeing the capital raising bonanza. For the calendar year there has been more than double the equity raising’s for the same period last year, and Private Equity has raised 12% more than this time year, $US133bn (preqin Data). Private Equity now sits on a war chest: $US1.46trillion (domestically the figure is estimated to be $11bn). PE is taking part in some of these listed raising’s. The market is watching closely.

So what happens if you don’t take up a discounted raising for a stock you already own?

Some of the unheralded government stimulus occurs here. An instance of such is the discount for raising’s has increased from 12% to 25%, in any 12 month period. Further, companies can do a two-for-one entitlement offer without existing shareholder approval (the previous limit was one-for-one).

Companies can also include the entitlement issue stock in the 25% placement limitation, so for the bean counters, a company can place up to 75% of its pre-raising stock with unknown parties. In one (terrible) instance, oOh! Medial ($OML) tapped the market for $167million and smoked its registry- existing shareholders were diluted by at least 82%.

Ultimately, not participating in these capital raises if you are an existing shareholder means your stake in the company is diluted. The speed in which these raises are opened and closed highlights how chummy the Banks, Fund Managers and Brokers are. A fund manager will often be briefed before the raising goes public, and if you are a retail shareholder? Well bad luck.

Cash short to participate in raising’s? Speak to us to find solutions that allow you to participate going forward.

Share Link